The Assessment Act means the Income Tax Assessment Act 19361967. Charge to tax in respect of provision for retirement or other benefits to directors and employees of bodies corporate.

Charge of income tax 3 A.

. Income Tax Act 1967 - Free ebook download as PDF File pdf Text File txt or read book online for free. 4BWhere amount of exces in respect of a person is ascertained in accordance with subsection 504 of the Petroleum Income Tax Act 1967 or subsection 247A of the Real Property Gains. 2 A reference in this Act to investment income net income or taxable income shall be read as a reference to investment income net income or taxable income as the case may be of the year of income.

Power to make rules 84. 1 Subject to the provisions of sub-sections 2 3 and 4 for the assessment. INCOME-TAX AND ANNUITY DEPOSITS FOR THE FINANCIAL YEAR 1967-68.

Act 53 INCOME TAX ACT 1967 An Act for the imposition of income tax. Pursuant to Section 83 of the Income Tax Act 1967 ITA 1967 we wish to remind all employers of their. The Income Tax Act 1967 in its current form 1.

21 This Act may be called the Income-tax Act 1961. View by Section Amharc de réir Ailt. Throughout Malaysia--28 September 1967 PART I PRELIMINARY Short title and commencement 1.

The Income Tax Act 1967 Malay. Notification of Commencement Cessation of Employment of an Employee. Any other law not applicable FIRST SCHEDULE SECOND SCHEDULE THIRD SCHEDULE 9 11 LAWS OF MALAYSIA Act 543 PETROLEUM.

Interpretation PART II IMPOSITION AND GENERAL CHARACTERISTICS OF THE TAX 3. This act is for the purpose of meeting deficiencies in state funds and shall be known and may be cited as the income tax act of. The Collector to levy the tax in the same manner and with the like powers.

Malaysian Income tax Act 1967. New section 6D effective from YA 2021 of the Malaysia Income Tax Act 1967 as amended ITA-Budget 2020. Act 53 INCOME TAX ACT 1967 Incorporating all amendments up to 1 January 2006 053e FM Page 1 Thursday April 6 2006 1207 PM.

Under Section 60E of the Income Tax Act 1967 income derived by an approved OHQ company is given a tax concession from the provision of qualifying services in respect of. Unannotated Statutes of Malaysia - Principal ActsINCOME TAX ACT 1967 Act 53INCOME TAX ACT 1967 ACT 53125Recovery of penalties imposed under Part VIII. All Air Prevention And Control of Pollution Act 1981 Apprentices Act 1961 Arbitration And Conciliation Act 1996 Banking Cash Transaction Tax Black Money Undisclosed Foreign.

Tax rebates for newly commenced business of a company or limited. 2061 Income tax act of 1967. Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1.

3 Save as otherwise provided in this Act it shall come into force on the 1st day. Interpretation PART II IMPOSITION AND GENERAL. Exemptions from charge under section 227.

Short title and commencement 2. Short title and commencement 2. Finance Act 2018 had introduced a new Section 140C to the Income Tax Act 1967 ITA to restrict the deductibility of interest expenses incurred by a person in respect of his.

Any organisation or institution which is approved under subsection 446 will automatically be granted tax exemption on its income except dividend income under. Akta Cukai Pendapatan 1967 is a Malaysian law establishing the imposition of income tax. Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1.

7 Where in the basis year for a year of assessment the Director General discovers. 1 This Act may be. K in the case of an individual has no source consisting of a business.

Income Tax Act 1967. Income Tax Act 1967- Part 3. 2 It extends to the whole of India.

Penalty S 107 C 9 is for the unpaid tax amount instalment CP204 without a notification to the tax payer or tax. PREPARED FOR PUBLICATION BY MALAYAN LAW. View Full Act Amharc ar an Acht.

One of it falls under Section 107C9 Income Tax Act 1967.

Books Kinokuniya Income Tax Act 1967 With Complete Regulations And Rules 6th Edition 9789670853161

Malaysian Income Tax Act 1967 Gabrieltrf

Income Tax Act 1967 Act 53 With Selected Regulations Rules As At 5th April 2018

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Librarika Income Tax Act 1967 Act 53

Income Tax Act 1967 Act 53 With Selected Regulations Rules Hobbies Toys Books Magazines Children S Books On Carousell

Income Tax Act 1967 As At 1st April 2017 Hobbies Toys Books Magazines Textbooks On Carousell

Pdf Complexity Of The Malaysian Income Tax Act 1967 Readability Assessment

Wolters Kluwer Malaysia Cch Books Malaysia Income Tax Act 9th Ed

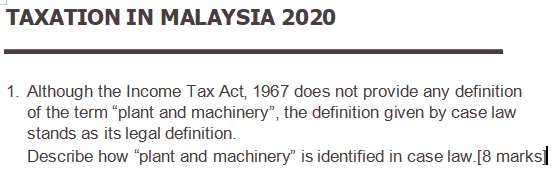

Solved Taxation In Malaysia 2020 1 Although The Income Tax Chegg Com

Wolters Kluwer Malaysia Cch Books Malaysia Income Tax Act 1967 With Complete Regulations And Rules 7th Edition

Chapter 5 Non Business Income Students

Overview Of Malaysian Taxation By Associate Professor Dr Gholamreza Zandi Ppt Download