Can Intellectual Capital Reporting be justified as a part of management accounting. Compare the prospect and problem of managerial accounting standards in private and public companies.

Iso Certification Halal Certification Certificate Pragmatics

A theoretical evaluation of the relationship between stock performance and CEO qualities.

. Top three implementation mistakes to avoid. The new standard ASC 606 provides a comprehensive industry-neutral revenue recognition model intended to increase financial statement comparability across companies and industries. Click a companys name to view its report.

Accounting Conferences 2022 2023 2024 is for the researchers scientists scholars engineers academic scientific and university practitioners to present research activities that might want to attend events meetings seminars congresses workshops summit and symposiums. Since 2001 those standards have been released under the name. Many private companies are breathing a collective sigh of relief since the FASB postponed the effective date for the new lease accounting standard ASC 842 now Q1 2021 for calendar year-end private companies.

The MPERS is a new financial reporting framework for private entities in Malaysia. A review of the degree of application of IFRS in the Asia Pacific- the case of Malaysia and Singapore. The Malaysian Government is now providing a 50 matching grant of up to RM5000 per company for small and medium enterprises SMEs to digitalize their business operations with online software such as Million Software Million is designed for both business owners and professional accountants from your business dashboard invoicing getting paid online.

The International Accounting Standards Committee IASC was established in June 1973 by accountancy bodies representing ten countries. Pengumpulan Data Buku Panduan dan Template Pengumpulan Data Tatacara dan Panduan Pengumpulan Data Statistik Pelawat Perakaunan Akruan Perakaunan Akruan Malaysia. Creditors include suppliers.

It devised and published International Accounting Standards IAS interpretations and a conceptual framework. Accounting Standards Codification ASC 740 Income Taxes addresses how companies should account for and report the effects of taxes based on incomeAccounting for income taxes can be challenging as companies navigate the rapidly transforming global tax environment changing business. Hundreds of companies around the world and across every sector are using SASB Standards to communicate financially material sustainability information to investors.

Discuss the accounting technology application in the informal sector. The Malaysian Financial Reporting Standards MFRS This is the MASB approved accounting standards for entities but this does not include private entities. The Types of Approved Accounting Standards in Malaysia.

Programme Learning Outcomes PLOs PLO1. This document is an excerpt from the FASBs The IASC-US. Companies Reporting with SASB Standards.

Lease accounting lessons from 200 public companies. What role does cooperate governance play in accounting standards implementation in. What Is the Definition of International Accounting Standards Strictly speaking the International Accounting Standards IAS are a specific set of norms for the presentation of financial accounts developed by the International Accounting Standards Board IASB.

GAAP copyrighted by the Financial Accounting Standards Board Norwalk Connecticut USA. This Bachelor of Accounting with Honours degree is a recognized accountancy degree under Part I of the First Schedule of the Accountants Act 1967. These were looked to by many national accounting standard-setters in developing national standards.

Financial accounting and reporting for income taxes. An analysis of the financial and management control mechanisms in the banking. Malaysia Public Sector Accounting Standards MPSAS Garis Panduan Pelaksanaan Perakaunan Akruan Manual Perakaunan Akruan MPA Arahan Operasi Aset dan Inventori.

The one-year deferral has some. Acquiring knowledge in financial accounting and reporting in accordance with approved accounting standards. Crowe is the fifth largest accounting firm in Malaysia providing audit tax corporate advisory risk consulting growth consulting and wealth management.

It offers the Chartered Certified Accountant qualification which is based on the globally-recognised international accounting and auditing standards. APPENDIX D SUMMARY OF THE FASBS IASC US GAAP. GAAP and IFRS Accounting Standards two of the most widely used accounting standards in the world.

Your accountants and bookkeepers no longer need to keep piles of papers and perform cross checking manually. Go paperless with Biztory accounting cloud and its tools for corporates SMEs and businesses today. It provides vital information for investors and other external parties and brings clarity to major decision-making in business management.

The credit terms and standards are set on the basis of the financial health of a business so it helps them to analyze by using the accurate information accordingly. These links are provided as a convenience and for informational purposes. In this article we give an overview of the MPERS highlight some key differences with the Malaysian Financial Reporting Standards MFRS and the Private.

The 2022 edition includes updated and expanded guidance that reflects standards effective as of January 1 2023 for calendar-year. 25 Jul 2022 This Roadmap provides an overview of the most significant differences between US. Accounting data and analysis lies at the very heart of good management.

Biztory cloud based accounting software makes your daily accounting tasks simpler and faster. Discover extraordinary ways to grow. If you have a business-related degree and want to develop your understanding of accounting and management in a business context our Accounting and.

Private Entity Reporting Standards PERS This is the. The list below provides a diversity of examples. The Malaysian Accounting Standards Board launched the Malaysian Private Entities Reporting Standards MPERS on 27 October 2015.

Unlike an accounting degree that covers many subjects beyond the field ACCA offers more in-depth and specialised knowledge about accounting particularly at the Professional Level. A Report on the Similarities and Differences between IASC Standards and US. There are three types of approved accounting standards here in Malaysia.

The Importance Of Generally Accepted Accounting Principles Gaap

Ias 8 Prospective Or Retrospective In Changes In Accounting Policies And Estimates

Accounting Services Corporate Tax Singapore Bookkeeping Services Accounting Services Business Loans

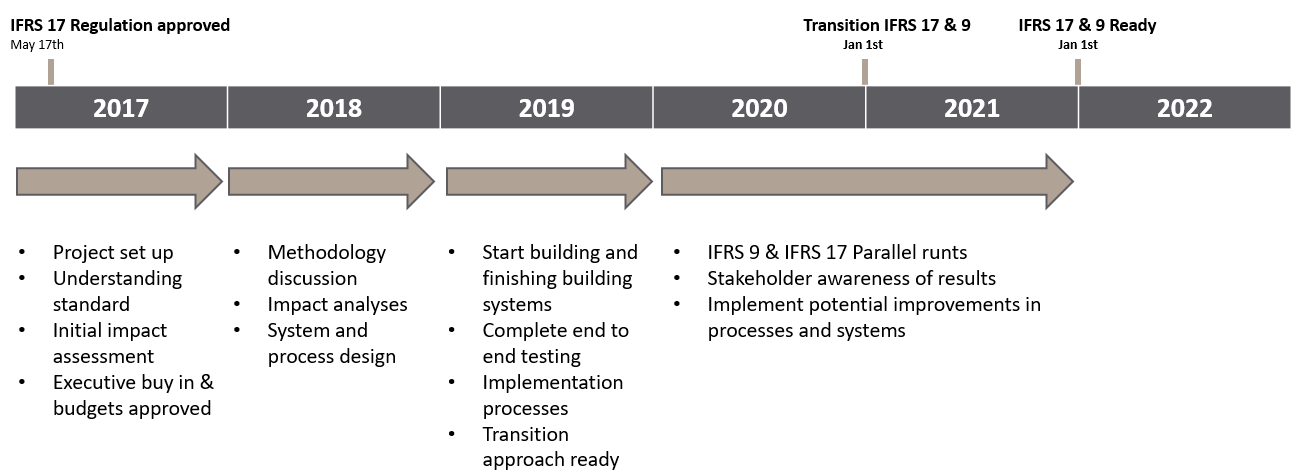

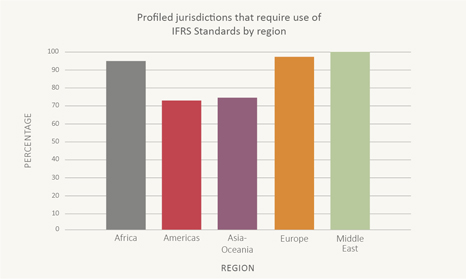

Ifrs 17 Explained Understanding The New Accounting Standard

What Is Gaap Generally Accepted Accounting Principles Definition From Whatis Com

Clarity The First Principle Of Ifrs Part 1 Of 4

Difference Between Conceptual Frameworks And Accounting Standards Difference Between

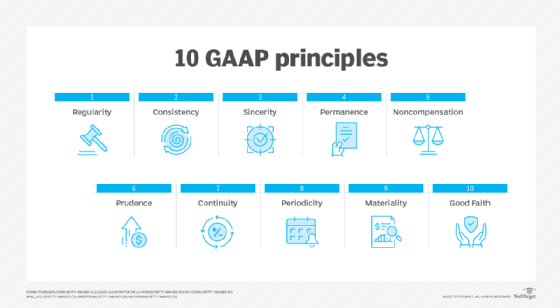

Ifrs Why Global Accounting Standards

Theory Of International Financial Reporting Standards Ifrs Implementation Emerald Insight

Solution Manual For Advanced Financial Accounting An Ifrs Standards Approach 3rd Edition Solution Manual For Advanced Financial Financial Accounting Solutions

The Ultimate Guide To Construction Accounting

Difference Between Conceptual Frameworks And Accounting Standards Difference Between

A Beginner S Guide To The Accounting Cycle Bench Accounting

Accounting Standards As Objectives Benefits And Limitations

We Are Offers High Technical Standards Accounting And Advisory Service With The Aim In Our Quest Accounting Services Audit Services Digital Marketing Services

Accounting Standard Overview History Examples

Finance For Non Financial Managers Dammam From 27 April To 01 May 2014 Who Should Attend Financial Decisions Financial Management Accounting Principles